New Supply Showing Its Impact

The first half of the year has been a challenging one for the multifamily industry in many respects. Persistently low apartment demand paired with the most active new construction pipeline in decades has sent average occupancy tumbling and taken the remaining momentum out of rent growth. The Greater Fort Worth market has typified these national trends so far in 2023.

All numbers will refer to conventional properties of at least fifty units.

New Supply and Net Absorption

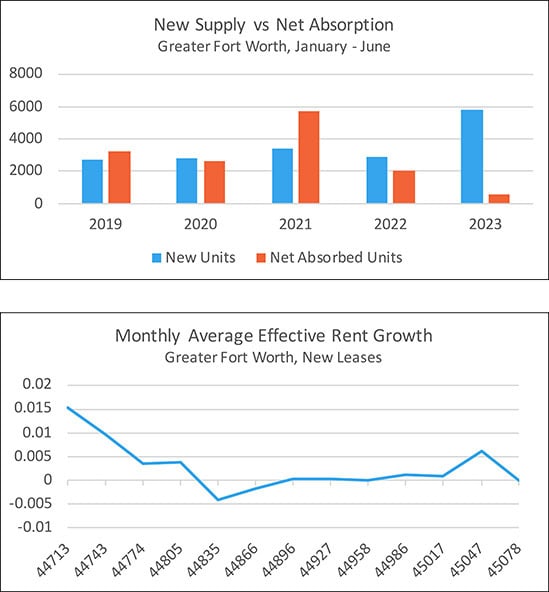

Whereas the Greater Dallas side of the metroplex has not seen the surge in new supply that many Sunbelt markets have, the same cannot be said for Greater Fort Worth. About 5,800 new units delivered across the region through the first half of the year was roughly double the volume of new supply in the first half of 2022. It was also the most for this portion of the calendar of any recent year by a wide margin.

75% of the twelve ALN submarkets for the area saw some level of new supply in the period. North Fort Worth led the way with almost 1,400 new units, followed by the approximately 1,200 new units introduced in South Arlington. The Denton – Corinth submarket was the other standout in new supply with almost 1,000 new units delivered.

While the construction pipeline was providing a deluge of new units, apartment demand was flagging. Net absorption of less than 600 through June was by lowest total of any year in the last decade – and there was no close second. The silver lining was that the second quarter did bring with it some substantial improvement. A net loss of around 400 net leased units in the opening quarter was followed by a net gain of just over 1,000 net leased units in the second quarter.

The effect of much higher deliveries and much lower demand was an average occupancy decline of 2.4% in the first half of the year. June closed at 88% – the lowest of any June in more than ten years.

Average Effective Rent and Lease Concessions

Another major difference from previous years has been rent growth. Average effective rent for new leases rose by only 0.8% in the first half of 2023. This came after a gain of 8% in the first half of 2022 and an increase of almost 7% in the same portion of 2021. The average unit finished June leasing for around $1,440 per month for a new resident – up about $250 from twenty-four months ago.

Only two submarkets suffered a loss in average effective rent. The Grapevine – Roanoke – Keller region saw the average drop by 1.5% and North Arlington declined by 0.6%. On the other side of the spectrum, the West Fort Worth area managed a gain of 4% in the period. Other standouts included Central Fort Worth and South Arlington with appreciation of about 2% and 1.5% respectively.

As would be expected, lease concessions have begun to play an increasing role in the market. A 70% increase in availability in the first half of the year resulted in around one-quarter of conventional properties offering a discount for new leases by the end of June. This was the highest rate of availability since the pandemic period, and the upward trend is unlikely to be over. The average discount value also rose, bringing the average to just more than 5% or close to three weeks off an annual lease.

Takeaways

It has been a tough year so far for Greater Fort Worth multifamily. A significant increase in the output of the construction pipeline has come at a time when apartment demand has remained stubbornly tepid. The associated drop in average occupancy has finally vanquished the consistently high rent growth of the last two years and operators have moved decisively toward lease concessions in recent months.

The traditional season boost in demand did materialize in the second quarter relative to the first, but not nearly to the magnitude needed to offset new supply. More troubling for the area is that a series of headwinds remain for the back half of the year. New supply is not expected to materially slow, and only a couple of months remain in the usually stronger portion of the calendar for multifamily demand. Macroeconomic concerns remain, and are arguably building, and student loans are currently set to resume payments in October.

In the bigger picture, fundamentals remain robust for Greater Fort Wort – but the ongoing correction from the post-pandemic boom period and the weight of new deliveries have probably not yet taken their full toll.

Jordan Brooks

Senior Market Analyst – ALN Apartment Data

Jordan@alndata.com

www.alndata.com

Jordan Brooks is a Senior Market Analyst at ALN Apartment Data. In addition to speaking at affiliates around the country, Jordan writes ALN’s monthly newsletter analyzing various aspects of industry performance and contributes monthly to multiple multifamily publications. He earned a master’s degree from the University of Texas at Dallas in Business Analytics.